The real estate cycle is important because the stages provide clues to predict the status of property assets. It is especially important since the cycle can influence the supply and demand indicators that are involved with the success of your property investment. If your property is within a certain phase of the real estate cycle, then what could be your next move? Understanding the real estate cycle’s phases is key to what strategy you should undertake for your current portfolio. It can also help you calculate when and for how long should you do investment related actions (buying, holding, or selling properties). Upcoming issues, exchange between buyers and sellers, and exchange between landlords and tenants shall be easier to anticipate. The health of the cycle suggests the flow of performance, income, valuation, and appreciation of the property. These factors shall be used by the investor to settle capital improvement judgements.

What increases property value?

Property price is directly related to the property’s valuation. The higher the property value, the greater the return of investment especially from income or for sales. So, what are the factors that can affect property value?

- Short-term constituent – various short-term factors hold information which can be utilized within the range of 0-5 years of investment.

- Long-term constituents – long-term factors that is generally observed and used within 6-15 years of investment.

The listed factors are what can inherently raise the valuation of a property. These individual factors moderately affect your property, but they greatly improve the values as a whole constituent.

Take note that even if one factor can negatively affect the value, there are other values that can make up for that negative factor which entails to high property value.

Short-term constituent

Land availability and cost – All land and property supplies are subjected to varying taxes. Real estate developers typically buy huge tracts of land to be subdivided for housing properties and this situation contributes to the price inflation in the housing market.

Economic overview – High employment levels are a sign of economic growth and these levels can curb down inflation. People with stable income can afford to borrow money for investment ventures for passive income. With low inflation, these people will eventually engage in the property market and this phenomenon gradually increases demand and property value.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Credit access – Property value starts and continues when investors are able to buy new property. Investors usually have access to credit and use this borrowed money on top of their capital to acquire properties. Lending policies are rather strict because borrowing power entrusted to property investors can remarkably affect property prices.

Interest rate – Interest rates are basically the cost of borrowing money from lenders. The rise and fall of interest rates can decrease and increase property demand and price. The same effect is emulated in property value as rising interest rates can constrict the rental income and end value.

Consumer confidence – The foundation of consumer confidence is the state of economy. When the economy flourishes, it boosts consumer confidence or optimism about their current financial standing which heightens consumer spending especially on goods rather than services. The assertiveness of these people can direct them to buy new property with their spare cash. This optimism is highly similar to population interest and demand which compels property value to increase.

Supply and Demand – When property demand is greater than the supply, property price and value will increase. Whenever property supply is greater than demand, then property price will decrease and property value will diminish.

Check out “Capital Growth Trends Every Property Buyer Needs to Know”

Incentives – Incentives and grants for first-home buyers is a strategy by the government body in order to administer demand into the property market of certain areas. This also uplifted the economy and create job opportunities for the industries that are closely affiliated with real estate. The *Help to Buy Scheme is one of the newest housing policies which shares equity between the buyer and the government. (*Introduced by Australian Labor Party in 2022)

Risk appetite – Investment comes with risk, and it all depends on the investor’s comfort zone until what end are they willing to risk to invest on a certain property. In the population of people who acquire properties in the housing market, property investors comprise around 30%. Favourable market conditions drive these investors interest and demand for properties which results to an increase in property price.

Long-term constituent

Nation’s wealth – National household income and housing demand have a direct relationship; this means that they both increase and decrease together. Property price and household wealth (money households have) also have a direct relationship where if one increases, the other increases as well. One can also say that household demand is directly related to household health. Due to the whole ordeal of the pandemic, people have realized and re-evaluated their living conditions and what they would like to have in their own home. Whether it was to upsize their living space or living suburbs further away from the highly urbanized cities or living in walkable cities. The importance of household demands to property value is that there are people who actively go after their taste and type of properties.

Demographics – Demographics is the structure and composition of a population in an area which relate to socio-economic and housing features. The demographic population include both nationals and immigrants. Researching the area’s demographics can help determine where they want to live and how would they live in that matter. Thus, demographics can sway the types of properties that are in demand and how each property is to be priced.

Check out “How to Find Your Next Investment Property in the Current Market Using Real Estate Data?”

Population growth – Population growth not only include the birth of nationals, but also the number of immigrants settling in Australia. Whereas supply and demand are simply short-term constituents, population is a long-term constituent. As population continues to grow, the demand for properties will increase as well. Increase in international students, migrants, and immigrants shows how healthy and wealthy a nation’s economic status would be. All of the population will inadvertently reinforce long-term property values.

What is the effect of economic growth on real estate market?

Economic growth increases the capacity and supply of goods which means that there are higher levels of employment to keep the circulation of goods and services going. The creation of job opportunities brings about the demand to live somewhere and eventually working close to their homes. This pushes up the property price of the real estate market.

Population growth and economic growth are typically interconnected, the same goes for economic growth as well as housing and rental demands. Businesses improve their products and services in order to charge more since expenses increase with each economic growth. As cost-of-living increases, it’s either people downgrade to save up money or they follow the trend and raise their lifestyle. Housing demand in the midst of economic growth is relatively the same as in any real estate market cycle. Rents will eventually rise when housing demand increases, if you want the housing demand to increase for your investment property then it is important to research on demographics. The demographics of the property area can help you determine what is the purchasing power of the population. The purchasing power of the population must be relatively high before you decide to adjust your rental rate, otherwise, you’re only driving away your potential tenants and may as well increase your vacancy rate.

When is the best time to buy a property and invest in the property market?

First things first, there is no right or wrong time to buy a property because there is no guarantee that you would be able to purchase the property if you wait for some time. You may not know, someone else was able to snag the property while you were waiting. Most of the information earlier should have given you a gist of how you should buy a property depending on the property market cycle.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Smart and experienced investors are able to strategize and still make a profit whether they bought the property during the boom phase or the stabilization phase. The property market cycle indicates what strategy should be used and what terms should be carried out to negotiate an offer to acquire properties. As an investor, you should also learn the mood of the economy and its people, the cycle phases relate to the emotions of an individual seller or buyer. Whether they feel like they want to sell their property during the boom phase or they feel like selling the property since the property market is recovering or they are desperate for cash thus they want to sell.

The best time to buy a property is when you are ready with your money, all the information needed to decide, and all the possible terms you can negotiate with. You must have confidence on your decision because no matter what, there is always opportunity for profit in property investment.

Property investment data is critical when making an investment decision

Take advantage of our fully customisable tool to help you choose which areas have both Good Capital Growth and Positive Cash Flow and to stay ahead of the game, against the less-knowledgeable property investors, local real estate representatives, developers and owners. With our tool, you can narrow down the 15,000+ suburbs by combining all 40 data points as filters. You can also compare historical & current performance of selected suburbs. When you have narrowed down your list and identified the best location, you can also do feasibility studies on five properties you have shortlisted simultaneously.

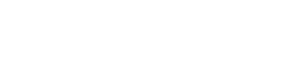

SuburbsFinder lets you overlay Days on Market versus Online Listing Market Demand to provide a better understanding on what’s happening in a particular suburb

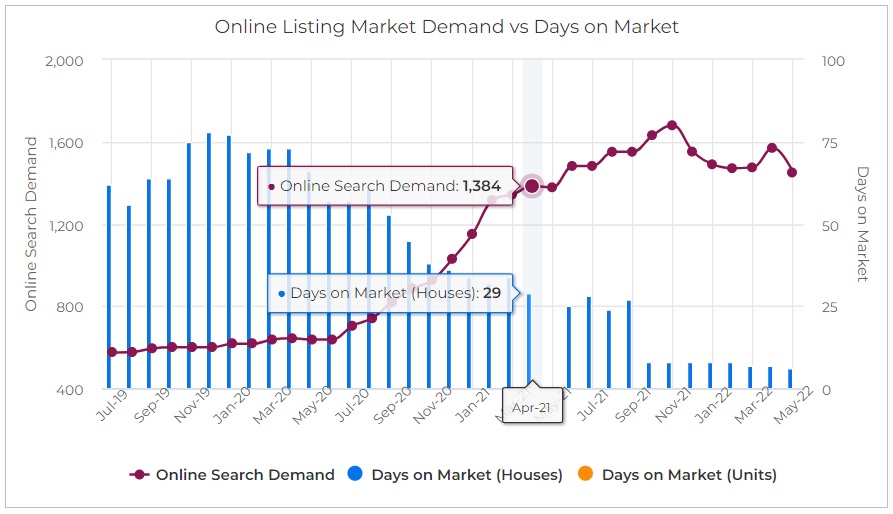

You can also overlay Sale Listings with Median Price for both Houses and Units showing the impact on price when supply can’t keep up with the demand

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcodes. It’s the perfect tool for property investors (like you) looking to buy a property with good investment potential.