If you’re wondering how to transform your negatively geared property into a cash-flow-positive investment, there are practical strategies you can implement to boost your rental yield and increase income.

Whether you’re looking to reduce holding costs, add value to your property, or explore innovative rental models like room-by-room letting, this guide will show you how to significantly improve the cash flow from your investment property.

What Is Rental Yield?

Rental yield is the annual rental income generated by a property expressed as a percentage of its value. It helps investors understand how well their property is performing in terms of income.

- Gross rental yield = (Annual rent / Property value) × 100

- Net rental yield = [(Annual rent – Expenses) / Property value] × 100

While gross yield gives a quick snapshot, net yield offers a more accurate picture by accounting for costs like mortgage interest, council rates, insurance, and maintenance.

What Is a Good Rental Yield?

Generally, a rental yield of 5% or higher is considered strong. Keep in mind this benchmark varies by market, and a high yield should still be balanced with long-term capital growth potential.

6 Ways to Increase Your Rental Yield

1. Refinance Your Mortgage

Refinancing to a lower interest rate is one of the most effective ways to boost your cash flow. For example, if you have a $400,000 mortgage, reducing your rate by just 1% can save you $4,000 annually—or over $330 per month.

Shop around or speak to a mortgage broker to compare current rates, especially when the market is shifting or interest rates drop.

2. Add Value to the Property

Small improvements can justify a higher rent. Consider these additions:

- Air conditioning

- A dishwasher

- Internal laundry

- Adding a bathtub if one is missing

- Converting unused spaces into offices or utility rooms

Even cosmetic upgrades like fresh paint, new flooring, or better lighting can increase appeal and rental income.

3. Differentiate Your Property

To attract premium tenants, make your property stand out from similar rentals. Understand what your local rental market wants—whether it’s carpet over tiles, modern kitchens, or outdoor entertaining areas.

Ask your property manager for feedback on what features command higher rents in the area.

4. Add an Extra Bedroom

A three-bedroom home typically rents for more than a two-bedroom. In many cases, you can convert a large living area, garage, or even a large hallway into an additional bedroom for a relatively small outlay.

This can potentially increase your rent by 20–50% and also improve your property’s market value by tens of thousands of dollars.

5. Adjust to Market Trends

Speak with your real estate agent or property manager regularly. Ask:

“What can I do to increase the rent on my property without risking vacancy?”

Their on-the-ground insights can help you stay ahead of changes in tenant preferences and local demand.

6. Rent Out Rooms Individually

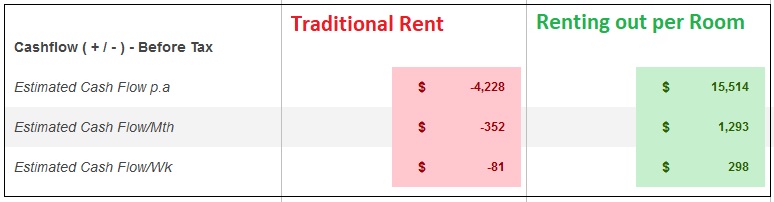

This strategy, known as co-living or room-by-room rental, can significantly boost your rental income—sometimes by 40–50%.

Example:

- A 5-bedroom house rents for $480/week under a single tenancy

- Rent out each room individually at an average of $200/week

- That’s $1,000/week or over double the standard rent

However, this model requires additional effort and compliance with local legislation.

Legal Considerations for Room-by-Room Rentals

Renting by the room can be highly profitable, but it’s critical to understand state-based tenancy laws. Your property may be classified as a:

- Rooming House (Victoria)

- Boarding House (NSW)

- Shared Accommodation Dwelling (QLD and others)

Depending on your state, this may require:

- Council approvals

- Fire safety upgrades

- Ongoing inspections

- Additional compliance with occupancy standards

You’ll also need to furnish each room and potentially include utilities and internet in the rent, increasing both setup and ongoing costs.

Important: Education is key. Know the rules and budget for the additional time and maintenance this model requires.

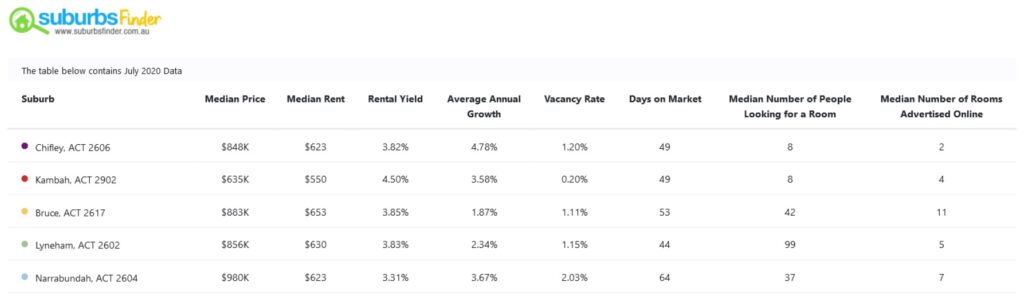

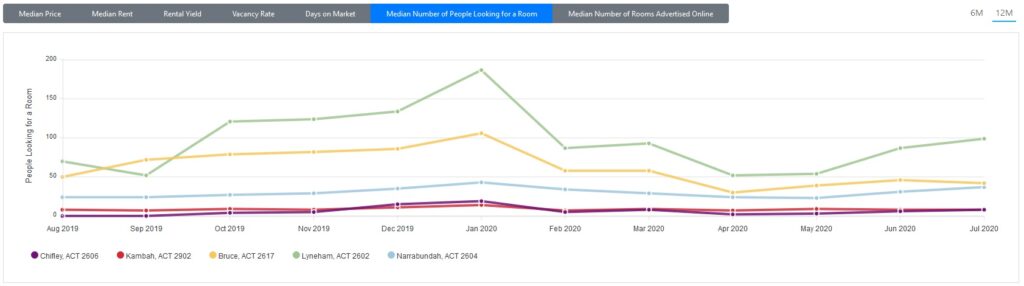

Find High-Demand Suburbs for Room Rentals

Property investors often ask:

- Which suburbs have the highest demand for room rentals?

- Where can I find co-living hotspots under $600,000?

- What areas offer strong capital growth and high yields?

Instead of spending hours researching, use our data-driven platform to discover:

- Suburbs with high room rental demand

- Areas offering over 6% gross rental yield

- Locations with annual capital growth above 5%

- Properties under $600,000 with strong demographics

🎥 Watch: How to Find Suburbs with High Room Rental Demand

Get Instant Access to Our Room Rental Demand Report

Our platform provides the most comprehensive location report across 15,000+ Australian suburbs. It includes:

- State, suburb, and postcode

- Median property value and rent

- Rental yield and vacancy rate

- Population and income data

- Capital growth and mortgage repayment estimates

This tool is perfect for investors building a positive cash flow portfolio through co-living, room-by-room rentals, or traditional single-tenant strategies.

Typically, you as the owner of the property will need to make some changes to the fixtures and fittings of the property and then market it as a Sharehouse or a Home of Multiple Occupancy (HMO) – applicable in NSW or what they call a “Rooming House” in VIC.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

For example, if you own a five bedroom house that is renting for $480 per week, rent out the 5 rooms individually at different rates depending on the size of the room with the tenants sharing common facilities such as bathrooms, kitchen and living rooms. The reasoning, and often the reasoning of so-called property experts, is that by renting out each individual room to a separate tenant, you can probably collect a minimum of $200 per room per week, thus immediately increasing your rental return to $1,000 per week.

While it may look appealing to be collecting 40% to 50% more rent by renting out individual rooms, most owners who take on this strategy fail to increase their rental return significantly due to the associated costs. Education on this area is really the key to make this strategy a success as every state has different Shared Accommodation or Co-living legislations.

So if you like give this strategy a go, make sure you get educated, budget accurately for all the additional expenses you will incur and don’t forget to include the increased time it will take to look after the property.

What are the best suburbs to buy an investment property to rent out rooms? What are the Top 10 share house suburbs in Australia? What suburbs in Australia have a high room rental demand and have a good capital growth? These are the most common questions property investors ask and it involves a lot of time researching to find answers to all of these.

The good news is, we’ve already done those hard work for you. Within seconds, you’ll be able to identify which certain suburbs are more desirable from people who are looking for room/s to rent or have a high room rental demand combined with a good capital growth.

Turning a negative cash flow property into a strong income earner is possible with the right strategy. From refinancing and adding bedrooms to renting out rooms individually, these proven methods can dramatically shift your financial outcome.

Just remember: more income potential usually comes with more work. Do your due diligence, get expert advice, and stay compliant with local legislation.

Check out our Room Rental Demand Report

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property to rent out rooms individually to have a positively geared portfolio.